Taking out a good personal loan isn’t a bad idea at all. Getting a payday loan isn’t a bad idea either. The only bad thing is taking the wrong loan from the wrong lender. The good thing is that once you get a suitable loan lender eager to offer you the best loan terms, you will never have to look for loan lenders. Currently, the internet is jammed with countless money lenders. While this aspect possesses the needed effect of making online loan lenders much more competitive, it can certainly make the process of getting a proficient lender complex and cumbersome.

In order to simplify your money hunting process, the likes of Cash USA are able to link customers with a proven moneylender, with the view of offering them with the best and reliable rates in the industry. If you are planning to use Cash USA for your personalized loan requirements, make sure you read this detailed review. We have covered everything from the qualification needed, its features, the ugly truth about Cash USA, and whether it’s legit or not.

What is Cash USA?

Cash USA is typically a third-party platform that connects those searching for personal loans with loan lenders such as Big Picture Loans and CashNetUSA. Cash USA has a couple of money lenders within its network, ranging in scope and size. With this in mind, when you borrow a loan from Cash USA site, you aren’t really getting a loan from the organization. Instead, the company simply connects you with suitable money lenders on the basis of your personal circumstances and requirements.

Here’s a Short Video on Cash USA

Cash USA is no different than other third-platform sites such as My Instant Offer, Lending Tree, and Lowermybills.com.

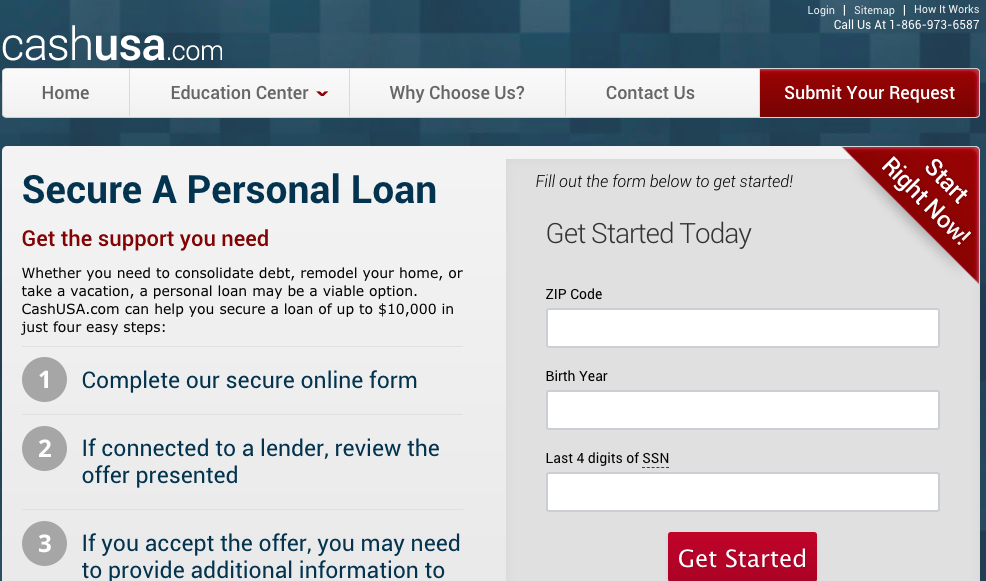

When you visit the Cash USA website, you will realize that the website is simple and easy to use in nature. In my opinion, I like the site as it is because it lists everything that users need to know on one webpage. This comprises all of the required points, like the eligibility, types of rates on offer, as well as the terms of loan agreement given to the customers. In simple terms, Cash USA organization has the ability to connect you with loan lenders that provide loans between $500 and $ 10,000. The loan interest ranges anywhere between 5.99% and 35.99 %, while the repayment period ranges between 90 days and three years.

The Qualification Process

As said above, Cash USA isn’t a direct loan lender. Instead, the platform operates as a comparison website so as to link you with a lender based on the details you fill on the registration form. Nevertheless, the process is artless. Once you visit Cash USA’s official website, you will need to input the amount you want to borrow, alongside some personal details like your full name, date of birth, and address. The chances of being approved for a loan are high when you give them truthful information.

After this, you will need to tell the organization your current FICO score range (Poor-Excellent) as well as what you need to loan for. It is essential to note that the reason you give for getting the loan does not affect your chances of loan approval. The reasons for loan borrowing only helps the organization tailor their products to the appropriate audience. With this, the purpose of the loan is effectively irrelevant, whether it’s for business expansion or home improvements.

You will also need to give additional info regarding your financial background before the platform allows you to submit your application. This comprises the common factors such as your employment status (part-time or full-time, business owner, among others), your present debt levels, and your monthly income.

After submitting the details as mentioned earlier, the Cash USA will start working its magic. Just like other comparison websites on the internet, you will be offered a list of suitable money lenders, alongside their projected financing costs. Afterward, you will be directly taken to the lender in question’s site to finalize your application if you decide to progress.

What is the Cost of Cash USA?

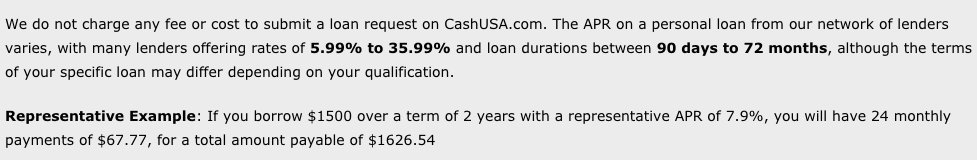

Cash USA isn’t a direct lender, and this means that the cost of your loan is based on what you’re given. The platform operates on a soft credit check basis, and this means that the loan lenders will base their terms on the info given in the Cash USA application form. However, according to Cash USA, the personal loans aided through the organization’s platform will come at an APR (annual percentage rate) rate of between 5.99 % – 35.99%. As is stated in the online lending space, the actual rate you are offered is based on a range of factors such as FICO score, loan size, current debt levels, income, and desired loan term.

See the screenshot below.

Other Costs to Consider

While Cash USA does not charge you if you decide to progress with any of its affiliated lenders, neither will they charge you any costs for searching – you need to think about the particular costs charged by the loan lender you opt to take your loan from. Particularly, this covers an original fee. Cash USA will make sure that they give you the initial charge within its search results, but you must clarify this once you go to the lender’s webpage. In most cases, an original fee is charged by most lenders as a means of covering the expenses of arranging the loan. This can range from zero to 5 % of the loan amount offered.

Am I Qualified for the Cash USA?

You need not worry irrespective of the state you reside within the United States of America because Cash USA serves all states. However, the platform will only be able to give loans to specific states when you use a direct lender because the organization is needed to hold a license in every state they operate in. Nevertheless, you will likely get a lender irrespective of where you are based since Cash USA has partnered with various lenders in all USA states.

In addition, consumers need to meet some minimum requirements if they’re to use the Cash USA program for their personal loan necessities. As a minimum, you must meet the following conditions:

- Be a US citizen or a permanent resident of the USA

- You should be aged eighteen years and above

- Your monthly net pay income must be at least $ 1,000

- You should possess an active checking account in your name

- You should have access to both work and home telephone number

Note:

It does not mean that you will be automatically given a loan just because you meet the above needs. This is because the moneylender takes into account factors such as your debt levels, FICO score, general creditworthiness, and income.

Cash USA Ugly Truths Revealed!

While borrowing a personal loan comes with loads of benefits, it also comes with potential drawbacks, which all users should take into consideration. Here are some ugly truths about Cash USA!

High-Interest Rates

The interest rate is based on the individual’s precise financial circumstances, ability to repay, as well as the lender’s creditworthiness. The interest rates are significantly higher than a secured loan supported by an asset primarily due to the high-risk factors involved for the lenders. It is an uphill battle getting the best interest rates when borrowing an emergency personal loan because you will be subjected to extremely high-interest rates if you have a bad credit score.

Not a Direct Lender

Cash USA is a platform that links you with a lender based on your current employment situation and financial background. It means that you will receive a loan and make repayments to a company other than Cash USA.

Very Strict Requirements

Due to the high risks involved for lenders, you should expect Cash USA to be extremely selective about the individuals they recommend loans for. When approving or disapproving an individual’s loan, there are various aspects a lender will take into consideration, one of the leading being FICO score. Some other vital factors are as discussed above. These factors give the lenders a clear indication as to an applicant’s ability to repay the loan.

A small loan Amount

When a loan applicant is found to be higher risk – with a low credit score or job instability – Cash USA will automatically limit the amount they’re willing to offer. Remember, money lenders will extensively go through pretty extensive checks on anything from employment history to credit score to define the repayment ability.

Luckily, there are several ways of improving your financial standing and credit score to make sure that you get the needed loan amount. This entails diversifying your credit mix, keeping a close eye on your credit reports to guarantee the accuracy, paying your monthly bills on time, among other vital do’s and don’ts.

Poor Better Business Bureau Rating

At the time of this review, Cash USA has the lowest possible BBB rating, an F. Receiving an F from Better Business Bureau is a sign of not very trustworthy company.

What I Like About Cash USA

The process is straightforward and effortless, but you still might be speculating what benefits you enjoy by working with a platform like Cash USA as opposed to performing the entire process yourself. Here is what I like about using Cash USA services:

Secure Website

The leading worry of users applying for online loans is their security. A borrower needs to opt for a lending portal that embraces safe and secure platforms. Cash USA utilizes state-of-the-art encryption technology to ensure that your entire private info is private and safe. Besides, the website runs daily tests to make sure that the system remains safe and that there are zero security leaks.

Quick Loan Request Processing

As opposed to applying via a traditional bank, your online request is quickly processed when you work with Cash USA. As a matter of fact, a loan request can be sent to loan lenders straightaway. In comparison to the weeks that it can take for a loan application to go through the daunting bank bureaucracy process, that is priceless.

Auto Pay and Online Payments

One of the impressive features I liked about Cash USA lenders is the convenience of making payments. It is possible to make monthly payments online. There is no relying on the postal service or mailing checks, as well as hidden late fees because a payment delayed or got lost in the mail. Also, Cash USA lenders allow you to set up auto payments for your convenience. With this essential functionality, you will never think about monthly loan payments again.

Is Cash USA a Scam?

Cash USA isn’t a scam! It is indeed a remarkable online tool that helps consumers get the best personal loan lenders in the market. Cash USA has formed dependable partnerships with a wide range of lenders, and this means that most credit profiles are taken into consideration. Although the actual loan terms are based on the applicant’s credit profile at the time of application, Cash USA says that the interest ranges between 5.995 and 35.99%. This offer is pretty decent, even at the higher end of the range.

Nevertheless, while Cash USA carries out a soft credit check once you go through the primary search, it is essential to remember that in unusual cases, a particular lender might perform a hard credit inquiry. However, this is only done when you actually decide to progress with the loan.

Also, while Cash USA guarantees transparency in the info they publish on their search results, you must authenticate the small print before signing an agreement. Most precisely, this revolves around hidden costs like an original fee. However, the good thing is that there are no fees charged by Cash USA for the search services they offer you.

Here’s what I Really Think

Whether you need a personal loan to make some crucial home improvements, unanticipated medical emergency, get away for a summer vacation, to consolidate uncontrollable credit card debit, an outstanding personal loan can be the answer. Using a platform such as Cash USA will not only offer you the most reliable and fastest lending options available, but it can link you with a lender that works best for you. This aspect ensures that the odds of you being approved for a loan much better. In most cases, your loan will be approved within a single business day based on the partner’s approval.