Zippy Loan Review- Is It Legit Or A Ripoff?

Do you need quick cash? Are you looking for a personal loan to solve unexpected or emergency expenses and think that Zippy Loan would have you to solve that, but not sure if they are legitimate or a rip-off.

In some cases, you have a small business idea that you want to start, which means that you will need a loan as quick as possible.

In this case, getting a loan from a friend or a family member may not be possible. Fortunately, there are some lenders willing to give you personal loans very fast so you can solve your problems.

However, the problem is that most people who need personal loans are usually desperate for cash.

Thus, it leads to making a bad decision such as getting a loan from loan sharks or making use of some lenders that are not genuine but out to rip you off.

I have seen hundreds of people make bad decisions when it comes to getting a personal loan because they have no clue who to use and how this type of loan works.

To be in safe hand, you need to use only trusted lenders when it comes to getting a loan. You need to make a research to ensure you are not about to fall for personal loan scams.

Fortunately, there are sites that exist today which can connect you to trusted lenders only. Zippy Loan is one of such sites. When you need a personal loan, sites such as Zippy Loan will be in your best interest to use. This is because they only work with lenders that have been verified.

What is Zippy Loan?

Zippy Loan is a platform where users can find large networks of lenders that are willing to give them up to $15,000 in personal loans. This company has been dealing with personal loans for years and has a large number of users who love making use of their services.

They are no different than other ” online lenders” sites as My Instant Offer, Lending Tree, Prosper, Upstart, and others.

Zippy Loan is very suitable for people who are looking to get personal finance to solve their financial problems. When you make use of their platform, they will help you find a lender who fits your needs as well as your budget.

When you need a loan, this platform will walk you through the simple process of submitting your request for a loan and match you to more than 100 potential lenders.

You have the right to sieve through these lenders until you find the one that completely matches your needs. You can decline or accept any lender. When you log onto their website, you are given full control of your lending capabilities and can easily transform your financial situation.

How Does Zippy Loan Work?

Zippy Loan works in a very simple way. The platform is very user-friendly. When it comes to getting a loan, the platform will put the power in your hands. This means that they don’t force you to accept any loan terms. You can go over through 100 lenders in order to find the one that completely satisfies your loan needs.

You will need to sign up before you can start to make the full use of their services. You will also be required to provide your full information including your name, phone number, email address, and your home and work address.

They will require that you verify your address. Zippy Loan will ask you to provide income and employment information. Mostly, the process of signing up only takes about 5 minutes or less, it can take a little more time if you are not internet-savvy.

When you get a loan, the repayment period is usually up to 60 months depending on the sum of capital needed for a personal loan.

You can still make use of Zippy Loan if you have a bad credit score. However, you may not qualify if your credit score is very bad, in this case, you might want to use any personal loan marketplace such as Badcreditloans.com.

If you meet Zippy Loan’s terms and conditions, they will connect you with a lender. You will now have to go through the lender’s offer to see if it is favorable.

You can as well negotiate when you are done with this process, you can now go ahead to e-sign your loan agreement if you have found a lender that offers you favorable terms. When you are approved, you can receive your loan in as little as 24 hours.

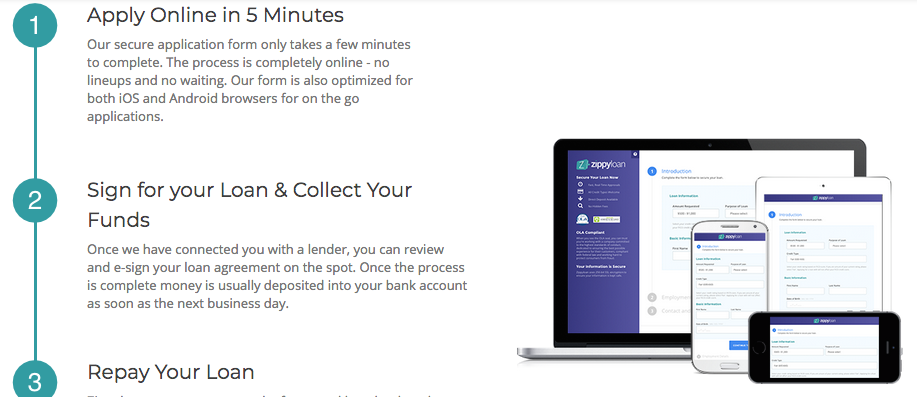

The process of getting a loan from Zippy Loans can be summarized in 3 steps:

Apply

The first step is to apply for a loan. Your application will be processed instantly and you will be matched with more than 100 lenders. There is no waiting involved in this step.

Get Your Loan

Once you are matched with lenders, you should review them to know which one is best for you. When you find the right fit, you can go ahead and select it then sign your loan agreement right away.

After signing your agreement, the money you requested for will be deposited into your bank account the following business day.

Make Your Payments

When you now have the money with you, you need to start thinking about paying the bank. Depending on the lender that gave you the money and also on the amount borrowed, you may have up to 60 months to completely pay back the money you borrowed.

Note that in some cases, you may not be approved for the amount you requested especially if you have a very bad credit. However, you can still be approved for lower amounts.

Who is Zippy Loans For?

Zippy Loan is for anyone who needs quick personal loan up to $15,000. There are not very many companies out there who can give you as much as $15,000 in personal loans.

Note that Zippy Loan is not a direct lender, however, the platform will match you to more than 100 trusted lenders who can give you the personal loan you need in 24 hours and also give you up to 60 months to pay back.

What I Like About Zippy Loans (Pros)

Zippy Loan is a trusted company that has been operating for so many years. My research shows that the company has good reviews from people who made use of their services in the past.

Some of the advantages of using Zippy Loans include:

- Helps you build your credit

- Connect you with trusted lenders

- Provides personal loan in just 24 hours

- Provides a quick and convenient cash

- Provides users with all types of credit

- Guarantees users security with 256-bit data encryption technology

- You can get a loan for renovations, repairs, debt consolidation, unexpected expenses and even loans for personal use from them

- They are very transparent

What I Don’t Like About Zippy Loans (Cons)

- The service is not for someone who is not internet-savvy

Can You Get Help From Zippy Loans When You Need It?

This is where it gets better; Zippy Loans provides a top-notched support. When you are stuck and needs a hand, you can easily get help from their customer service through a phone conversation or through their email service. Their customer service is very friendly and I found them to be very helpful.

Here’s What I Really Think

Zippy Loan can be your last resort when the bank has rejected you and you have no one to turn to in order to get a personal loan. The platform offers quick and convenient cash.

Ideally, the pros of using Zippy Loan significantly outweigh the cons. Besides, they are among the few companies that can give you up to $15,000 in personal loans.

When you are looking to get a personal loan quick and easy, I will recommend that you make use of Zippy Loans. Their service will definitely provide you with peace of mind that you won’t enjoy anywhere else.