Is Stash App Scam? This Review Will Answer This Question!

There’s a saying that once you become a billionaire, becoming a multi-billionaire isn’t going to be a challenge, it’s going to be an inevitability. This is because they are not working for money anymore. Instead, their money is working for them, which is what most people strive for. Once you have accumulated enough wealth, you can have that money grow if you invest it correctly, and that is what we’re going to discuss today. I am going to review a product that claims to help its users earn money by investing in a good market. The name of the program or app is Stash App. It’s an investment app that is used to access your investments on the stock market.

I am going to give an in-depth check look into the inner workings of the program to determine if it does what it claims to do. By the end of this write-up, you will have determined if this program is for you or not. I am also going to describe the type of users that would benefit the most from using this program. Without further ado, here’s my full review.

What Exactly Is A Stash App?

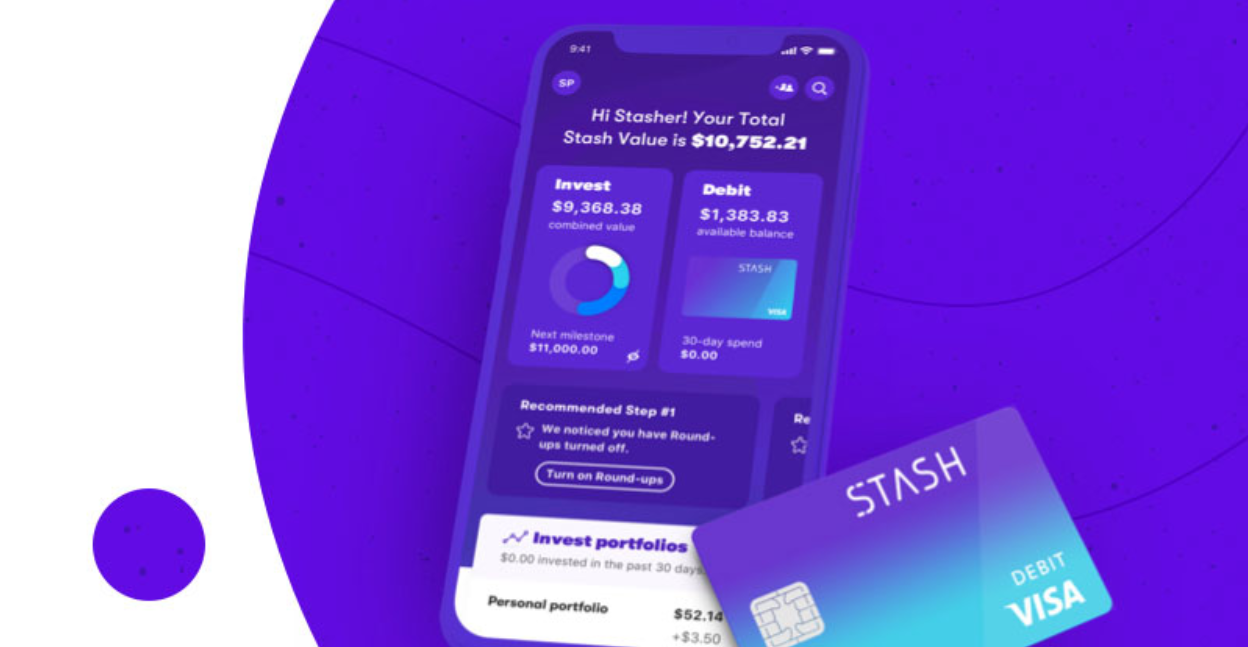

Stash is an investment app for smartphones from stashinvest.com that will give you access to the stock market, provided that you already have an existing account. It features a brokerage account and a selection of 30 exchange-traded funds (ETFs). Stash was founded in 2015, which makes it a relatively new app on the market. It is registered in New York City, which is what most people would consider the capital of stock trading.

The goal of this company is to have everyone have the capability to start investing by giving them access to the stock market. Their decided way of going about it is to give everyone access to an app that would allow them to invest with as little as $5. It doesn’t matter what kind of job or standing in life you might have – anyone can invest – and that’s their main goal.

How Does Stash App Work?

To give you a better understanding of how Stash App works, I will put up a short video summarizing how the app works. It will explain how you can use the program, who is it for, and what its capabilities are, albeit in broader strokes. If you want a more in-depth explanation, you should read this article further.

When you first signup, you will be given a question assessing your tendencies. You will then be given a quick evaluation which would categorize you as either Conservative, Moderate or Aggressive Investor. After that, you will have to deposit an initial investment and start trading as soon as possible. Take note that all of your Stash investments are insured by SIPC, which offers good security on all of your transactions.

What makes Stash great is you can easily choose which companies you can invest in based on your evaluation. If you are tagged as Moderate, there will come a lot of Moderate options for you. This includes companies, banks, and any other fund that offers a moderate amount of risk. Their investment portfolios have quirky names like “Be The Next Buffet” or “Park Your Cash Here” which makes it less intimidating compared to the usual robot-like description of other portfolios. And if you think about it, the name of their portfolios are pretty self-explanatory. For “Park your cash here,” we can safely assume that it’s one of that long-time investment plan.

How Much Do You Have To Invest?

That figure is entirely up to you. You can invest millions if you like, well, if you have the money, at least. Or have as little as $100. It’s entirely up to you.

Their minimum investment though is a cool $5, which anyone could afford. Even your kid can invest in this program. It’s that accessible.

What makes this a great app is you have full control of all your investments. You won’t have to pass through your broker before you make a trade. Simply click on a fund that you want to sell and you’re all set. You have to pay $1/month after your first month though. If you go over the $5000 balance though, you would need to pay 0.25% per year, which could be pretty steep especially if your balance is well above that range. In any case, you will save a ton from using this app by the lack of commission fees and bank transfer fees alone.

How Can I Start Using This Program?

You can download the app on both Apple and Android devices completely free of charge. You will need to provide your personal information when you sign up though. Also, you will need to answer several questions that would categorize you into the right investment style. You can fund your chosen investment type using any bank account but you will have to do 2 test deposits to ensure that your bank is connected successfully to the app. It could take up to 6 business days for your bank to be connected to your Stash account. The only real requirement here is you have to be at least 18 years to open a Stash account.

Negative Reviews Of Stash App

Like any app, this app also has some flaws in it, which is completely normal. I will list below the most common complaints about this program and check if there are some merits to those claims.

- There are some limitations

Stash only provides taxable brokerage accounts unlike other investment apps available on the market. That means that investors won’t be able to maximize their contributions to their retirement of 401k accounts.

- A-rating on BBB

Currently, they have an A-rating on BBB, which looks good on paper. However, they aren’t accredited by the same company. If you read the reviews of the users on its profile, you will see that most of the reviews are in the negative territory. Most of the complaints are related to billing and bank-linkability.

- Expensive subscription fees

They currently have a monthly fee of $1 per month for accounts under $5,000, which isn’t exactly a huge amount. However, if for instance, the balance of your account is only in the hundreds, $1 per month is quite a lot, relatively speaking. For accounts above $5,000, the subscription fee rises to 0.25% which again, does not look that much but when you have several thousand in your account, that 0.25% can easily balloon to something.

- It’s almost too easy

Let’s be honest here, this app is catered towards beginners. They even have a Facebook-like questionnaire that would help you determine which kind of investor are you. If you want a more in-depth investment app, there are several better alternatives.

- No tutorials

Stash currently does not provide in-depth tutorials on how to earn using their app. They basically just provide you with the app and all the learning will be up to you.

- Only available on app

It would be better for this platform if it also offers its users access to their portfolio on a desktop. As the type of this writing, users can only access their portfolio on the app.

Is Stash App Scam?

Stash App is not even remotely close to being a scam. It’s a legitimate program.

However, it’s not without flaws as evident by the things I’ve listed above. It’s a platform best for beginners who just want to not let their money rot on their savings account. If you want more control over your stocks or the funds you buy, you are better off using other investment apps. I’ve reviewed several items similar to this one. If you want to check out my other reviews, you can click here.

If you are looking for another type of online money-making opportunity, I would point you to my #1 most recommended program. I’ve been using this for many years now and I can only say positive things about it. If you are curious enough, click the link down below.