Is Acorns App A Scam? Is Automated Investment Worth It?

If you are looking for an honest Acorn Apps review, you are definitely in the right place. I have here an in-depth review of this item to help you decide if this platform is for you or not.

But before my full review, I want to extend my congratulations to you because you actually took the time to do research about this program before you use it. Not a lot of people research the products they want to try and the fact that you do already makes you smarter than the rest. It’s your time and money that you will spend here and it’s only fair that you would learn if this product is credible or not. So without further ado, here’s my review.

What Exactly Is Acorns App?

The mere idea of opening an investment account and having to manage it day in and day out can be a little intimidating. In fact, a huge majority of the population doesn’t even have their own investment portfolio because they deem it too complicated and time-consuming – and they’re not entirely wrong! If you want to open an investment account, you need to at least have an understanding of how it works. If you don’t know at least some of the terms of the industry, you’re at the risk of losing most of your money by way of a bad investment.

Having said all that, that’s where the Acorns App comes in. It literally makes investing much easier and more convenient for you. No more wasted time understanding all those complex market terms that, truth be told, you won’t actually ever need come time you start investing. Investing is actually as easy as anything you do. It’s just that the finance people make it unnecessarily complicated using their jargon and whatnot. In truth, they just want you to handover your investment money and let them have control.

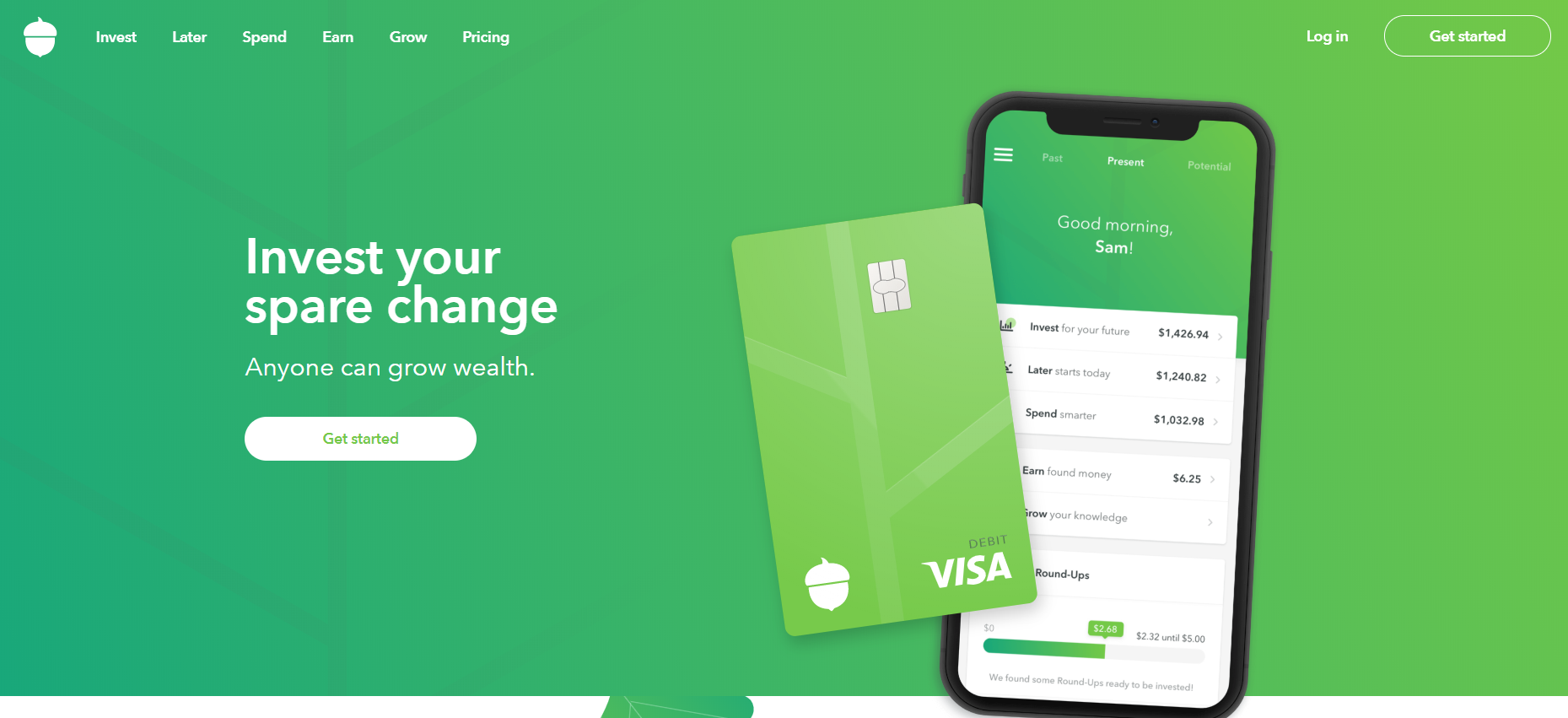

Acorns App makes all of that go away. It’s a smartphone app that does all the investing for you. Automatically! Acorns App claims to help you get started investing in the right companies by allowing you to invest using small change then gradually growing it to a respectable sum. It is founded in 2012 by Jeff and Walter Cruttenden, a father and son duo, with the aim of making an easy-to-use investing program to get everyone to start investing no matter how little money they have.

How Does Acorns App Work?

The idea behind the app is actually pretty cool. It also comes as a surprise that people did not come up with this idea much sooner. Basically, what this app does is it take any spare change you may have from your everyday purchases and makes investments with it.

To do this, you must link your bank account to the app. Then you make your purchases like you normally would. The only change is that Acorns App will round up all your purchases to the nearest dollar and the change will be invested in your account.

The idea is very simple, you buy a coffee for $2.50 and it rounds it up to $3.00. The $0.50 is invested into your exchange-traded fund. You are basically transferring all your spare change into your investment fund every time you use your card to make a purchase. This is actually a brilliant idea.

How To Use Acorns To Its Full Potential?

Apart from the automated spare change investment, you can also program your app to take money from your account either daily, weekly, or monthly. It depends on your financial situation at the moment. The thing is, you can program this app to do plenty of automated investing on your behalf. It’s like having a broker that is not as annoying and pushy on their “new” investment scheme.

Here are also some of the things you can do with the Acorns App.

Refer people to it

If you want to jumpstart your investment, you can start by referring people to the Acorns App. For every successful referral, you will earn a corresponding monetary value. At the time of this writing, the rate is about $250 for every successful 5 referrals, but these things seem to change without warning. If you want to learn more about their referral program and the current going-rate, you should check out this link – https://www.acorns.com/ref-terms/.

How Do You Sign Up With The Program?

You basically have two options if you want to join Acorns. Just visit the website and click on the sign-up button where it would take you to the registration page. You just need to fill out the form using your information.

Another way of registering an account to Acorns is to download an app from Google Play for Android or App Store for iOS. Since you are opening an investment account, take note that you will be using your personal information like social security numbers among other things. If you are a college student, you can join this program for free but only if you have a .edu email address. That’s at least four years that you can join for free.

If you aren’t a college student, Acorns would cost you $1.00 monthly fee for an account with a balance of $5,000 below. If your balance is more than that, you will be charged 0.25% per year. Depending on your experience with banks, you may think that their fees are good. In comparison, their rate is considerably lower than any brokerage firm or bank.

Good Things About Acorns App

- Ease of Access

This app is very convenient to use. You can invest using just your phone and no more of that intimidating financial talk with brokers. What’s more, is Acorns could get you started with $5 and work your way from there. Not everybody has big money sitting on their couch.

- Autopilot

Since you are going to invest your spare change from all your purchases, it would be an automatic thing. You don’t have to check throughout the day. Once you have your account setup, it’s all good.

- Risk Categories

You can select different risk levels depending on your taste. If you want to have a more aggressive portfolio, you can just click a high-risk, high-reward portfolio and be on your way. The rest would be automated. It just depends on your preference, really.

Bad Things About Acorns App

- Report of bugs in the app

There are some reported bugs on the app since it is still a relatively new app. The most commonly reported bug has something to do about the interlinking of the app and the bank accounts. For some reason, some banks fail to round up, thus failing to collect the spare change.

- Customer service can be hard to reach

When users report bugs to customer service, they usually don’t get a response right away, and the times they do, they are just canned messages that are not going to address the specific problem.

- If investment fund is small, the gain is also small

If you’re looking to get bigger investment gains, you need to put in a bigger fund. But the selling point of this app is you can start out with just a small fund. The fact is, your gains will be stagnant if you continue to put in tiny amounts of money in it.

Conclusion – Is Acorns App A Scam?

Acorns App is definitely a legitimate program. If you are new to investing and saving money, this is definitely a good starting point. The risk is also relatively low considering that you are likely going to invest some pocket change. I’m not saying that that is all that this program is good for. You can also do big investments if you wish to.

For me, I would definitely recommend this investment app to anyone, even college students. It’s a good program to use to dip yourself into the investment market. You can learn a lot of helpful stuff using this one.

But if you are looking for a more hands-on and aggressive online money-making opportunity, you can check out my other recommendation. When my readers ask for ONE recommendation, this is what I always give them. So far, all of them are saying positive things about it. Without further ado, here’s the program I’m raving about – My #1 Recommended Program!